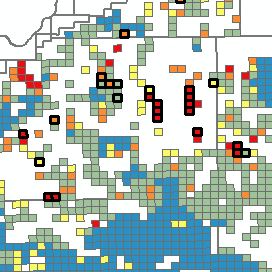

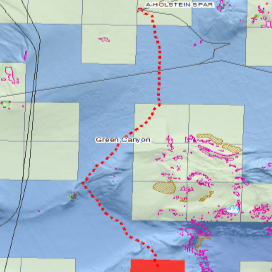

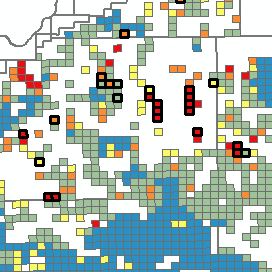

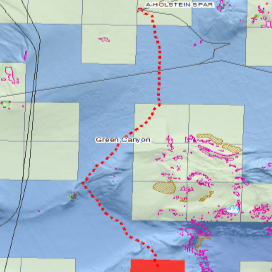

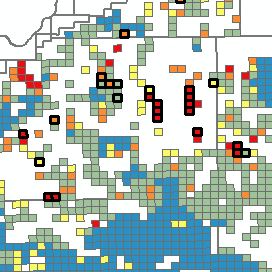

Bidding Analytics uses statistical models of 20 different variables (such as proximity to existing leases, previous bids, newly available, etc.) to estimate both the likelihood of a block being bid in the next sale but also an estimated amount bid. The analysis can be run on any or all companies, including groups of companies whose bidding behavior is similar based on these factors.